Disclosure of Information

Sustainability KPIs

- Total amount of sustainable finance to be executed 2trillion yen, of which 1 trillion yen is environmental area, from FY2020 to FY2030.

Amount of Sustainable Finance Provide, as of end of March 2022

190billion yen(of which, 90billion yen is environmental area)

- Net-zero CO2 emissions from FFG itself by FY2030.

SASB INDEX

FFG discloses the financially material sustainability information with the SASB* standards.

*SASB (Sustainability Accounting Standards Board) is founded in 2011 in the United States of America.

Correspond to TCFD

Initiatives addressing TCFD* recommendations

FFG has positioned efforts for addressing climate change as an important element of its business strategy. Aiming to share easy-to-understand and useful information with its stakeholders, the Group declared in August 2020 that it supports the recommendations of the TCFD. We have conducted scenario analyses of physical and transition risks in line with TCFD recommendations. Going forward, we will continue to maintain a system in line with these recommendations.

* TCFD: Task Force on Climate-related Financial Disclosures

Governance

- Under the direction and advice of the Board of Directors, the FFG head office has built an organizational structure to promote sustainability measures across the entire Group with the Corporate Planning Division as an administration division.

- Under the above-mentioned sustainability promotion structure, we prioritize addressing climate change as a pillar of FFG’s SDGs-based focus item of “environmental protection.”

- In order to clarify FFG’s roles and responsibilities regarding the risks and opportunities of climate change, our Risk Management Policy stipulates that the Board of Directors is responsible for developing and establishing various risk management systems based on the characteristics of the climate-related risk, and action plans and other related matters are discussed by the Board of Directors or the Group Risk Management Committee, depending on the nature of the climate-related risk.

- With regard to investments and loans, our Environment and Society-Conscious Loan Policy, which takes into consideration the demands of the international community for the prevention of global warming and our expectations for the realization of sustainable local communities, is clearly stated in the Credit Policies of the Bank of Fukuoka, the Kumamoto Bank, and the Juhachi‐Shinwa Bank, and decided by each bank’s Board of Directors.

Strategies

Risks and Opportunities:

- The main climate-related risks faced by the Fukuoka Financial Group are as follows:

| Type | Details of risk |

|---|---|

| Physical risk |

|

| Transition risk |

|

- In response to physical risks faced by FFG, we will conduct proper risk assessments of damage to FFG branches from natural disasters, and carry out maintenance and review locations of branches to strengthen BCP.

- As for opportunities created by physical risks to customers, we plan to further expand our risk mitigation scheme using insurance and other means, and BCP development and assessment support services.

- In terms of opportunities created by transition risks to customers, we will also incorporate SDGs perspectives into our initiatives for business assessment to create loans to help our customers seize new business opportunities emerging from the transition to a decarbonized society, etc. Furthermore, in April 2021 FFG established the subsidiary Sustainable Scale to support its SDG efforts. The company drives initiatives to achieve sustainability transformation (SX), in other words, to transform local communities and companies to prioritize sustainability in management by appropriately assessing SDG initiatives and making the quantitative results publicly available. FFG also plans to offer a wide range of services through this company to address the climate-related risks of corporate customers.

- Through these initiatives, we will realize our core value — to be “Your closest bank,” “Your reliable bank,” and “Your sophisticated bank,” which is embedded in our brand slogan: “To be your Bank of choice.”

Policy on Environmentally and Socially Conscious Lending:

- As interest in sustainability has increased in recent years, financial institutions also are expected to work to solve environmental and social problems through investments and loans.

- In response, FFG has formulated the Policy on Environmentally and Socially Conscious Lending to contribute to solving environmental and social problems through loans. The policy lays out points to keep in mind when considering loans for businesses that may have a negative impact on the environment or society, such as coal-fired thermal power plants.

- For more in detail, please refer to "Policy on Environmentally and Socially Conscious Lending" on the page "Policies" .

Scenario analysis:

- FFG utilizes scenario analysis to identify the impact of climate-related risks on the Group and establish strategic resilience.

- Based on the results of the scenario analysis, we will create business opportunities and mitigate risks for corporate customers by enhancing engagement with them to ensure they can adapt to climate change and transition to a decarbonized society.

| Physical risk | Transition risk | |

|---|---|---|

| Risk analyzed |

|

|

| Applicable portfolio |

|

|

| Scenario |

|

|

| Analysis method |

|

|

| Analysis results |

Up to 5.0 billion yen |

Total: 23.6 – 47.9 billion yen |

Risk Management

- Climate-related risks could impact every aspect of the banking business, and should they manifest, there would be ripple effects across every risk category including credit, market, liquidity, and operational risks. Our Board of Directors is actively involved in the development and establishment of proper risk management systems based on such characteristics of the climate-related risk.

- Climate-related risks that are deemed important are managed and addressed within a comprehensive risk management framework by risk category depending on how a risk is likely to manifest itself.

For example, we assess the physical risk of damage to FFG branches from storms and floods within the operational risk management framework, and appropriately control the risk by taking necessary measures such as reevaluating insurance policies. - In regard to climate-related risks in our credit portfolio, we quantitatively ascertain the level of impact through scenario analysis, and consider the proper course of action as needed.

Our scenario analysis method is still a work in progress and we are updating the types of usable scenarios as needed. FFG is working to improve the sophistication of scenario analysis with the help of external experts.

- With physical risks, we analyzed the damage to hypothecated property from disasters such as typhoons, heavy rain, and flooding, and the impact that the deterioration of financial conditions caused by the suspension of borrowers’ businesses would have on credit costs.

In the analysis, we ran a simulation of the changes in the size and frequency of disasters that an increase in temperature would cause based on a storm and flood model with the help of external experts and estimated the level of impact on locations and structures such as borrowers’ hypothecated property and places of business. Then we estimated the credit cost increase taking into account the increase in unsecured loans due to damage to hypothecated property and the changes in obligors’ categories due to the deterioration of borrowers’ financial conditions.

Based on the results, we were able to estimate that additional credit costs that may be incurred by 2050 due to physical risks for FFG could reach up to 5 billion yen. - With transition risks, we analyzed the impact that the deterioration of borrowers’ financial conditions from decreased sales and increased costs caused by the transition to a decarbonized society would have on credit costs. Specifically, we conducted an analysis of the utility and energy sector, which has been designated under the TCFD’s Supplemental Guidance for Banks as high transition risk carbon-related assets and for which development of analysis methods has progressed to a certain extent.

In the analysis, we engaged the help of external experts to create a scenario based on the NGFS’s orderly transition scenario in which carbon costs have increased, the power source mix has changed, and the demand for fossil fuels has decreased; forecasted changes in the performance of the target sector; and estimated the impact on ratings and credit costs.

Based on the results, we were able to estimate that additional credit costs that may be incurred by 2050 due to transition risks for FFG would be about 14-21 billion yen in total.

The range in this estimate is based on whether or not a transition in the existing business structure was assumed when forecasting changes in future performance.

Indicators and Targets

In order to further advance initiatives to address climate-related problems, FFG has decided to set targets and conduct monitoring for the following indicators.

We set specific target figures by taking into account the Japanese government’s environmental and energy policies, FFG’s business model, and other factors.

Targets

■Total amount of sustainable finance to be executed 2trillion yen, of which 1 trillion yen is environmental area, from FY2020 to FY2030.

■Net-zero CO2 emissions from FFG itself by FY2030.

- FFG developed a Group-wide environmental policy in April 2009, and has made efforts to prevent and mitigate the potential environmental impact of its own business activities.To achieve a decarbonized society, we are promoting “Eco Actions” including appropriate office temperature control, turning off vending machines during the night, encouraging workers to shut down computers when they leave their desk, and energy consumption management at the branch level. We are also increasing eco-friendly offices by introducing solar power generation systems and LED lighting for ATM booths at branches.

- About environmental policy, please refer to Environmental Policy on the page "Policies".

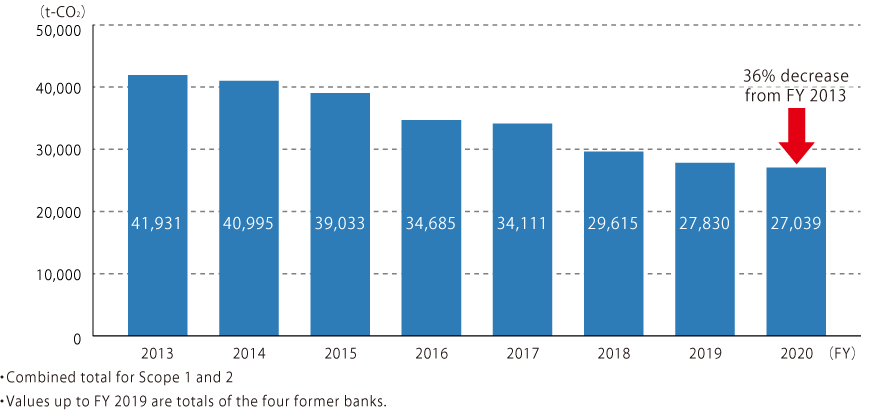

- As a result of these initiatives, in FY2020 the total of CO2 emissions (Scopes 1 and 2 combined) for the Banking Division (the Bank of Fukuoka, the Kumamoto Bank, and the Juhachi‐Shinwa Bank) amounted to 27,039 tons, a 36% decrease from FY2013.

- FFG began responding to the CDP* Climate Change Questionnaire from FY2020 to meet the needs of investors for environmental information from the Group. The resulting CDP score is as follows.

- The Fukuoka Financial Group will use external assessments such as that of CDP to promote effective climate change initiatives.

Related Information

About information for our Investors, please refer to the page "Investor Relations" and "IR Library" .

About our Corporate Governance and Compliance, please refer to the page "Company Information" .